1. Anxiety and Chronic Stress

Financial instability often leads to heightened anxiety. The fear of not having enough to cover essential expenses, such as rent or healthcare, can cause excessive worry, sleep disturbances, and even panic attacks.

Gostav Petorcik

Published on: February 23, 2025 • 5 min read

Financial uncertainty is a major stressor in today’s fast-paced world. Whether it stems from overspending, excessive saving, job instability, or economic downturns, the mental toll can be significant. In this post, we will explore the psychological effects of financial insecurity and how to safeguard both your financial and mental well-being.

Financial instability often leads to heightened anxiety. The fear of not having enough to cover essential expenses, such as rent or healthcare, can cause excessive worry, sleep disturbances, and even panic attacks.

When financial troubles persist, they can contribute to feelings of hopelessness and depression. Individuals facing long-term debt or unemployment may withdraw from social interactions, experience a loss of motivation, and struggle with negative thoughts.

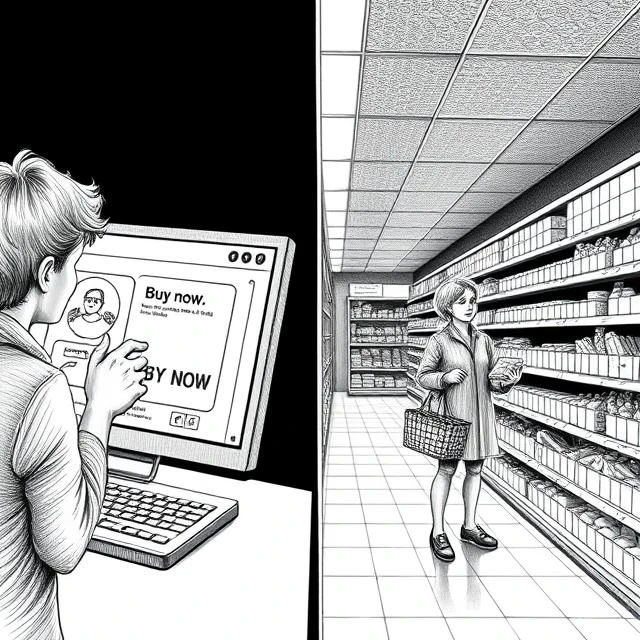

Stress related to financial uncertainty can lead to two extreme behaviors:

Impulsive spending as a coping mechanism to momentarily feel in control or happy.

Extreme saving or financial paralysis, where an individual is too afraid to spend even on necessities.

Money problems are one of the leading causes of conflicts in relationships. Disagreements over spending habits, debt, or financial planning can lead to stress and, in some cases, broken relationships.

Having a clear understanding of your income and expenses can provide a sense of control and reduce uncertainty.

A financial planner can help you set realistic goals, create savings strategies, and build a plan that minimizes financial stress.

Engaging in mindfulness, exercise, and relaxation techniques can help mitigate the mental strain caused by financial worries.

Even a small savings buffer can provide a sense of security and lessen anxiety about the future.

Discussing financial worries with a trusted friend, family member, or therapist can help reduce feelings of isolation and provide fresh perspectives.

Financial uncertainty affects not just your bank account but also your mental well-being. Recognizing the psychological risks and taking proactive steps can help maintain both financial stability and mental health. If you need assistance in creating a financial plan that works for you, consider consulting a financial expert.

If you found this article helpful, share it with others who might be experiencing financial stress. And remember, taking control of your finances is a step toward a healthier mind and a brighter future!